Chad Steingraber, a professional game designer and prominent figure in the XRP community, has recently updated his theory on the potential future price of XRP, originally published in August 2022. The theory, titled „The Chad Steingraber Theory,“ presents a complex roadmap that predicts XRP’s journey towards the incredible $20,000 mark.

At the core of Steingraber’s argument is the principle of scarcity of assets in relation to supply and demand. He explains how scarcity, similar to an auction where many bidders compete for a limited asset, can drive up the value of the asset.

„Asset scarcity, a part of supply and demand, is also a problem, like an auction bid where many people are bidding on a limited number of assets that only a few of them might possess.“ „This can drive the value up, it only stops when no one else is willing to pay a higher price,“ he notes, emphasizing that this scarcity could be a driving force for the valuation of XRP.

Steingraber also delves into the concept of market value appreciation and „phantom money.“ He explains how the current price of an asset can reflect its anticipated future value, a concept similar to selling the idea of a future desirable house on valuable land at today’s perceived value. He also introduces the term „phantom money,“ noting that market capitalizations often reflect perceived rather than actual invested value.

„Today, the market capitalization of XRP is $30 billion. But hold on, that doesn’t mean that actually $30 billion in money has been put into XRP. […] It’s far less, as market capitalization only reflects the current value someone is willing to pay. Phantom money, remember?“ explained Steingraber.

Steingraber draws parallels to unique and limited assets like the Mona Lisa, highlighting the perception of value. He points out that value is often attributed based on uniqueness and societal significance, explaining, „The Mona Lisa is valuable because it is the only one… That value is in our minds.“ This analogy serves to underscore the perceived value of the coin in the cryptocurrency market.

„The Chad Steingraber Theory“ – The Path to a $20,000 XRP (UPDATED)

A thread from The Future (UPDATED)

It’s been a year and a half since I wrote this original thread and A LOT has happened, including parts of this theory.

Grab a drink, a snack, and let’s get started, shall we?

– Chad Steingraber (@ChadSteingraber) December 30, 2023

Banks to Drive XRP Price to $20,000

At the core of Steingraber’s theory is the idea that banks will hold XRP as reserve assets, similar to gold. He explicitly states, „Banks holding XRP, that’s the Holy Grail,“ emphasizing the potential shift in the perception of XRP by financial institutions. This shift would elevate the status of the cryptocurrency, positioning it not just as a transactional cryptocurrency but as a fundamental asset in banking.

Steingraber envisions a future where banks will create private ledgers for internal operations, requiring significant XRP reserves. „Banks will create a private ledger and hold XRP as reserve value, like a central bank holding gold as a reserve,“ he explains. This approach to using XRP mirrors the traditional banking system’s reliance on gold and suggests a paradigm shift in managing digital assets.

The theory also underscores the crucial role of liquidity hubs like Metaco in this new banking ecosystem. Steingraber points out that these hubs would need to maintain large XRP balances to facilitate transactions between banks. „The LHs also hold a remainder of XRP because they are the third-party exchange that requires a transfer of the issued IOU derivative on the XRPL to another IOU derivative,“ he notes, highlighting the importance of XRP in this process.

A key aspect of Steingraber’s theory is the resulting scarcity of XRP on the public market as banks accumulate it. He predicts a significant shift in the public supply and explains, „The circulating public supply of XRP on crypto exchanges is far less than people think… The banks are coming, when they are ready to grab the public supply of XRP, and when they have it… IT’S GONE.“ This expected scarcity is anticipated to trigger FOMO (Fear of Missing Out) among financial institutions, leading to a rapid depletion of the public availability of XRP.

Steingraber’s theory culminates in the forecast of a massive surge in the price of XRP, attributed to the combined effects of banks treating XRP as reserve assets, the creation of private ledgers, the pivotal role of liquidity hubs, and the resulting scarcity of public supply. He anticipates that the value of the cryptocurrency will skyrocket in the future due to these factors, potentially reaching up to $20,000.

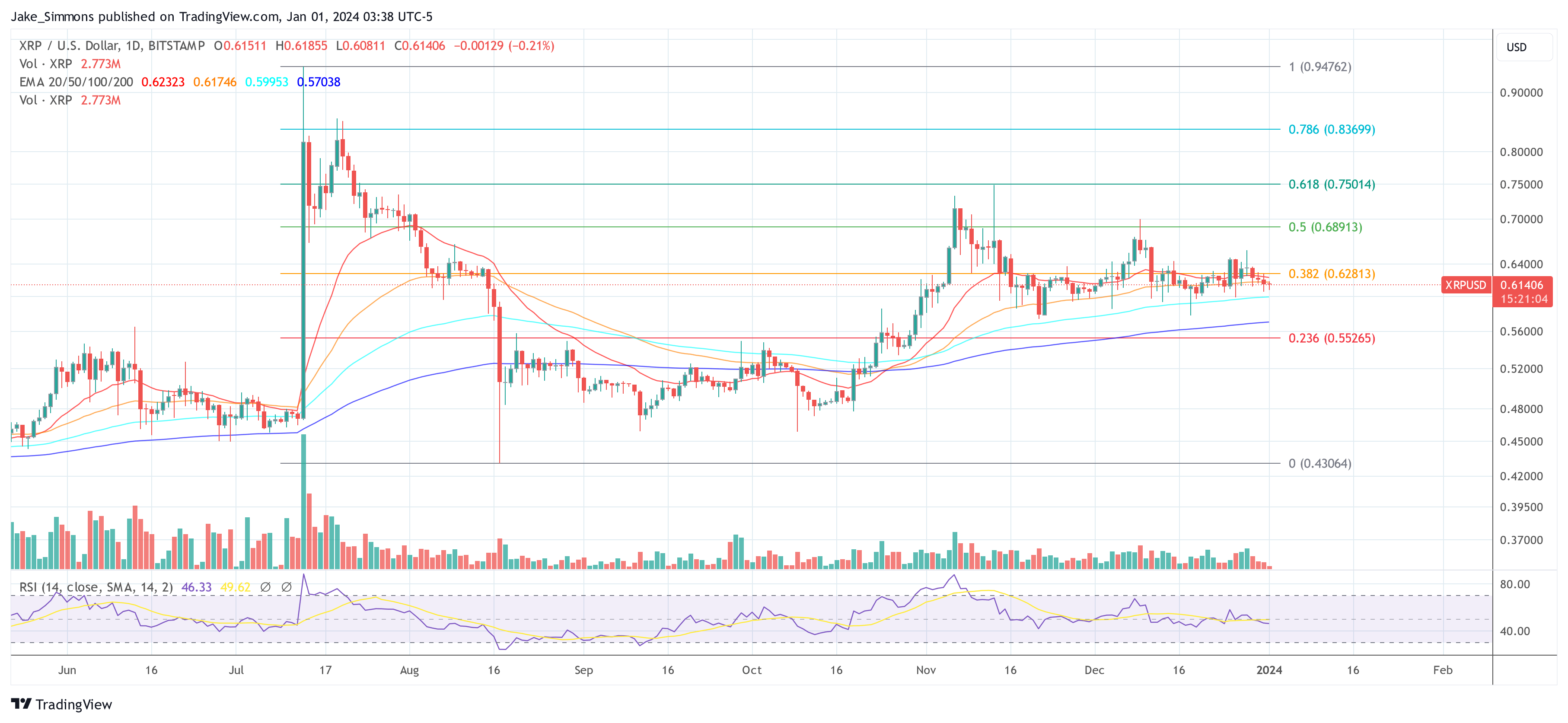

At the time of writing, XRP was trading at $0.61406.

The argument presented by Steingraber introduces a complex and multi-faceted perspective on the potential future of XRP’s valuation. Whether this theory will materialize remains to be seen, but it has certainly sparked discussions and debates within the XRP community and beyond. As the cryptocurrency market continues to evolve, it will be interesting to observe how the dynamics outlined in this theory unfold and impact the trajectory of XRP.