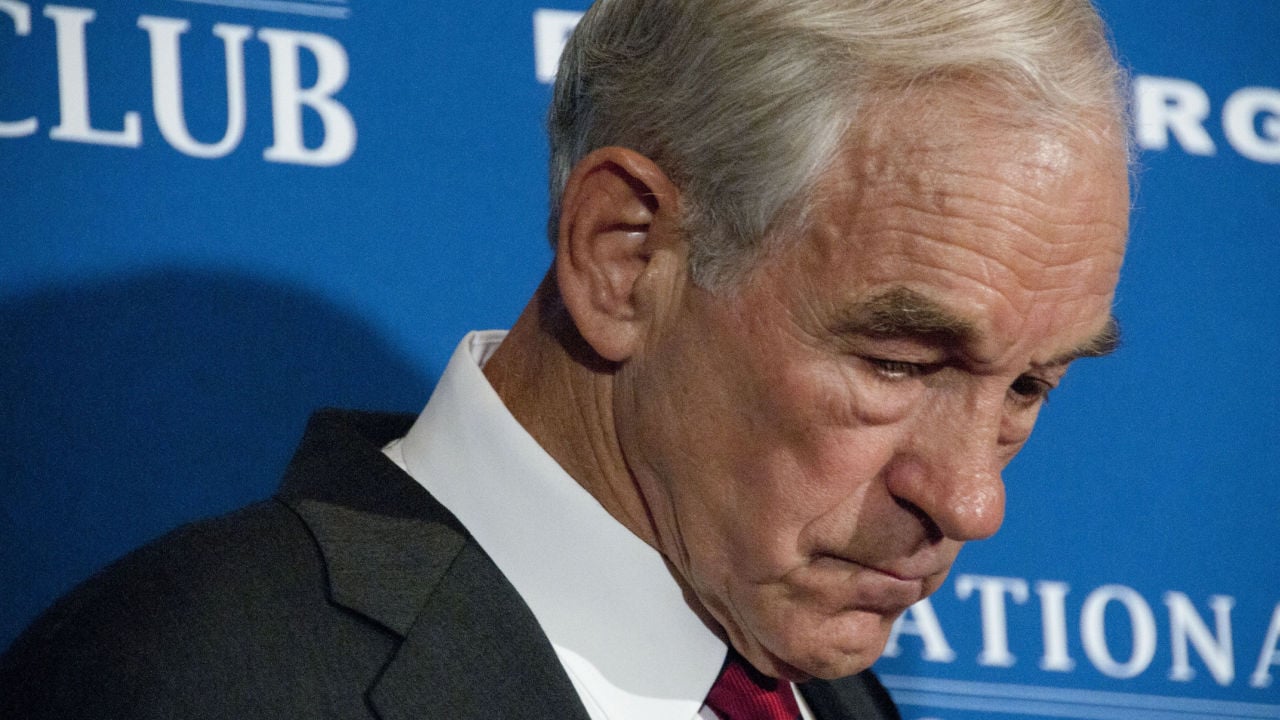

Ron Paul sagt: „Federal Reserve verursachte Finanzkrise mit einem Jahrzehnt von fast 0%-Zinsen“ – .

Ron Paul, the former representative and presidential candidate, has expressed his views on the U.S. financial crisis, stating that the policies applied by the Federal Reserve to maintain a welfare state at the cost of creating deficits have created the current financial hardships for the country. Paul criticized the monetary policies that allowed bad debt to be created with credit going to non-profitable investments, and described the situation as becoming unsustainable due to the tightening of economic conditions.

Paul also addressed the role of the Federal Reserve in the U.S. financial crisis, noting that the continuation of quantitative easing (QE), a policy used to increase the money supply, and the decades of almost null interest rates, nurtured the current financial crisis the U.S. faces. However, Paul praised the action of the institution that is currently trying to rein in inflation by raising interest rates, even if this has affected the banking system according to government spokespersons.

Despite being a longtime critic of the validity of the existence of the U.S. Federal Reserve and its faculties, Paul believes that the institution is part of the solution to the financial crisis. He stressed that rising interest rates under Powell are the cure and road back to some form of economic sanity, but also noted that the Fed shouldn’t exist. He deemed it unconstitutional and immoral due to the negative effects of their fiscal policies.

Furthermore, Paul has been warning the public about the de-dollarization process and the effects that losing reserve currency status might have on the U.S. Although he believes this process has accelerated recently with the recent activities of the BRICS bloc, he stated that it would likely take longer than some predictions indicate and that there is no established timeline for this to happen.

In conclusion, Paul’s criticism of the Federal Reserve and the continued implementation of quantitative easing and almost null interest rates have nurtured the current financial crisis the U.S. faces. While Paul has been a longtime critic of the institution’s validity, he acknowledged its role in resolving the financial crisis through rising interest rates but still finds it unconstitutional and immoral due to how their fiscal policies have negatively affected various aspects of the U.S. economy. Finally, Paul warned the public about the de-dollarization process and its effects on the U.S.’s reserve currency status, which has yet to have a concrete timeline or defining shift away from the dollar.